Table of Content

- How the Mortgage Interest Tax Deduction is Changing in 2018

- The Largest Deductions Taken by High-Income Households

- Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

- Should I deduct my mortgage interest?

- What Is the Mortgage Interest Deduction?

- Who qualifies for this deduction?

- The Home Mortgage Interest Deduction and the Tax Treatment of Housing

Kristen uses 300 square feet of their home for a qualified business use. Lindsey uses 200 square feet of their home for a separate qualified business use. In addition to the portion that they do not share, Kristen and Lindsey can both claim 50 of the 100 square feet or divide the 100 square feet between them in any reasonable manner. If divided evenly, Kristen could claim 250 square feet using the simplified method and Lindsey could claim 150 square feet. If you share your home with someone else who uses the home to conduct business that also qualifies for this deduction, you may not include the same square feet to figure your deduction as the other person.

Following the financial crisis of 2008, policymakers began to question whether the HMID should be allowed to reduce costs for homeowners if it subsidizes riskier loans. This shift made changes to the HMID viable for 2017 tax reform. Deductibility of home equity interest depends on what the home equity loan was used for. If the home equity loan was used to improve the taxpayer’s home, the interest is still deductible, subject to the limits discussed in the previous section. On the other hand, if the home equity loan was used to cover personal expenses, it is no longer deductible. Figure the average balance for the current year of each mortgage you took out on all qualified homes after October 13, 1987, and prior to December 16, 2017, to buy, build, or substantially improve the home .

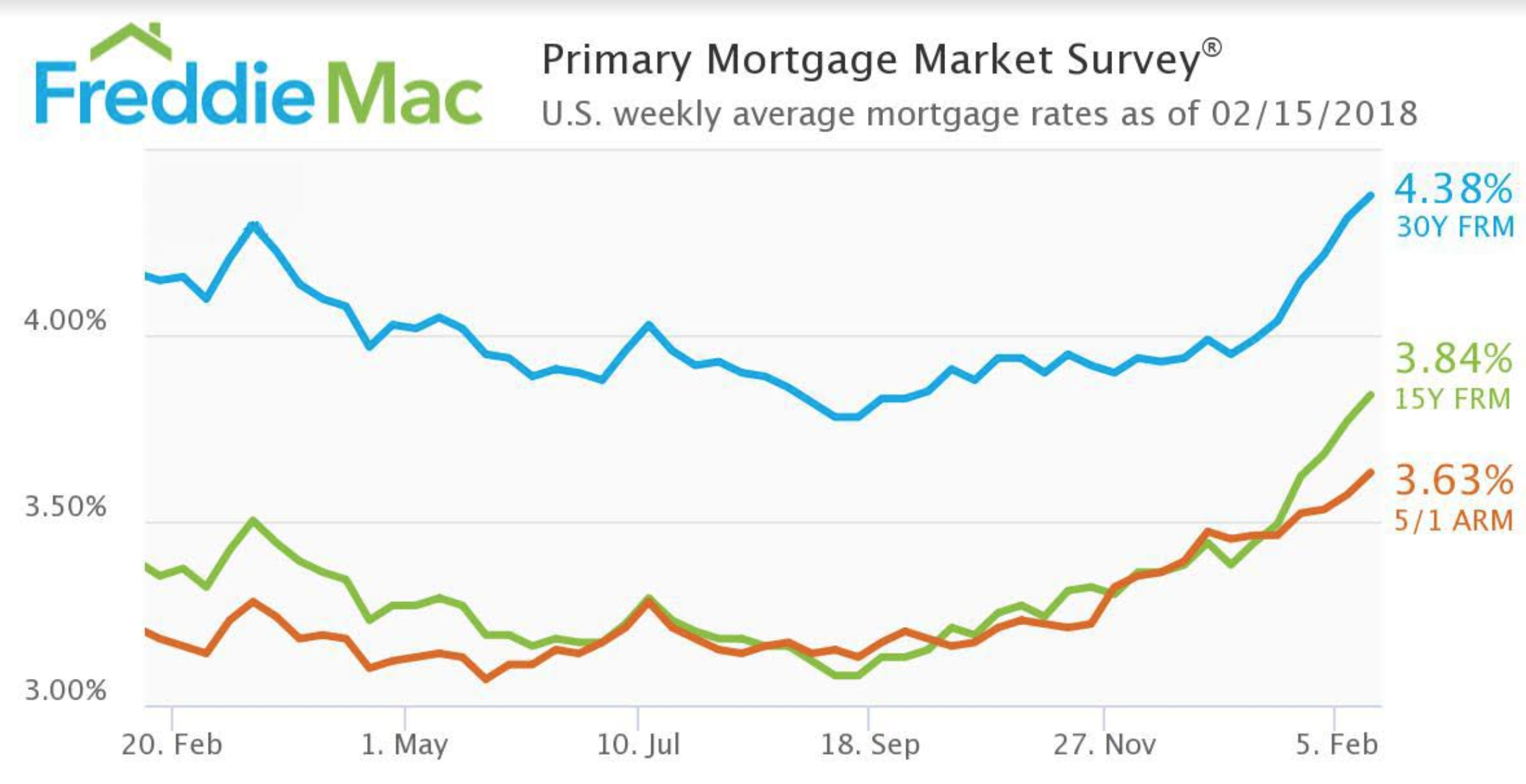

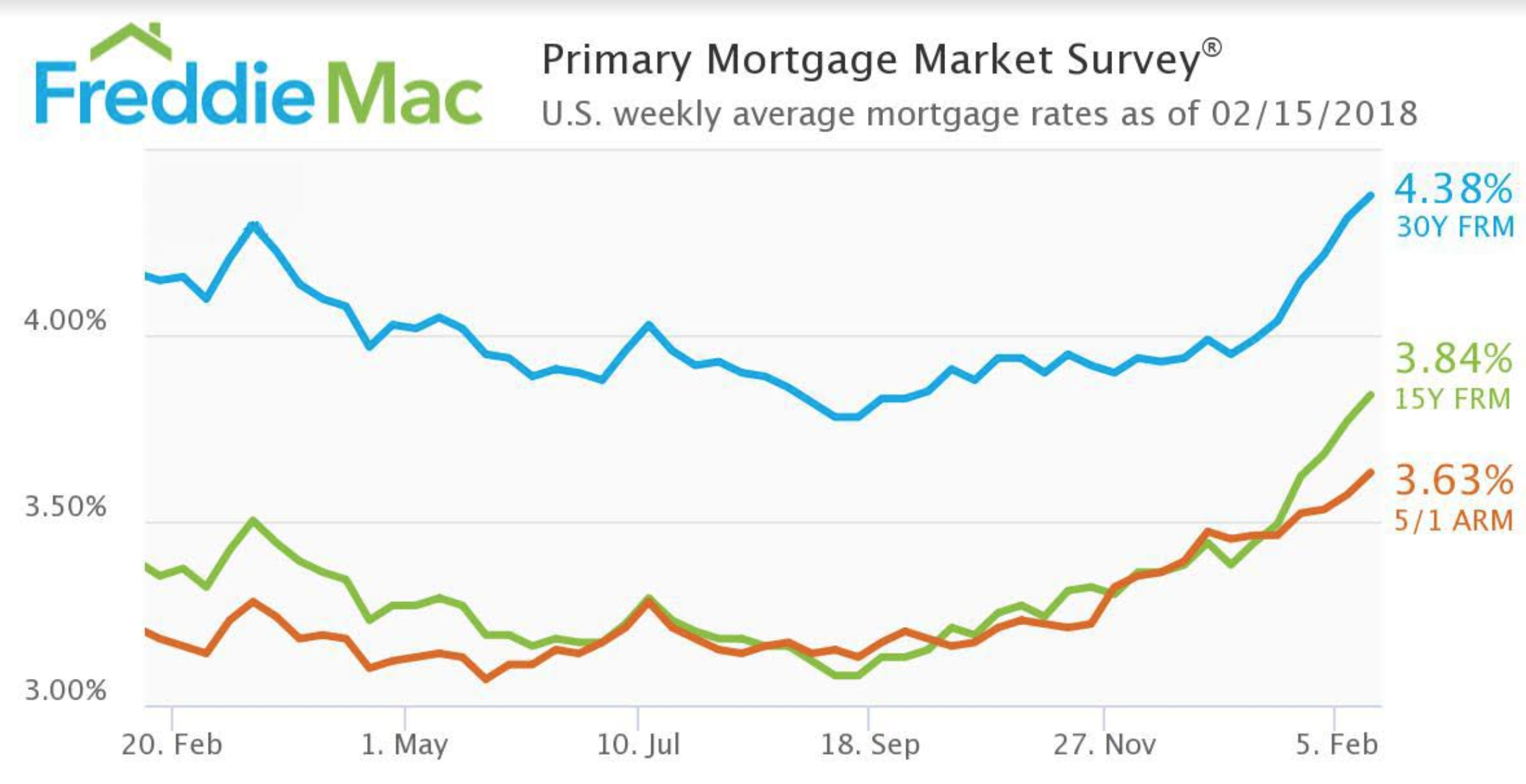

How the Mortgage Interest Tax Deduction is Changing in 2018

This is less than her deduction limit , so she can deduct the entire amount. She follows the instructions to complete the rest of Part II and enters $1,756 on lines 34 and 36. Mortgages taken by single filers or married couple filing separately after October 13, 1987, and before December 16, 2017 qualify for a deduction up to $1,000,000 or $500,000 each for married couples filing separately. The mortgages must have been used to build, buy, or improve the home to qualify for the deduction.

The total of the mortgage balances for the entire year is within the limits discussed earlier under Home Acquisition Debt. You can deduct all of the interest you paid during the year on mortgages secured by your main home or second home in either of the following two situations. If the debt before refinancing was like a balloon note (the principal on the debt wasn't amortized over the term of the debt), then you treat the refinanced debt as grandfathered debt for the term of the first refinancing. Repairs that maintain your home in good condition, such as repainting your home, aren't substantial improvements. However, if you paint your home as part of a renovation that substantially improves your qualified home, you can include the painting costs in the cost of the improvements. The cost of building or substantially improving a qualified home includes the costs to acquire real property and building materials, fees for architects and design plans, and required building permits.

The Largest Deductions Taken by High-Income Households

Your home office will qualify as your principal place of business if you meet the following requirements. If you need information on deductions for renting out your property, see Pub. If your loan is from before Oct. 14, 1987 it’s considered “grandfathered” debt and is subject to no limits nor rules about how the funds were used.

Therefore, the interest is fully deductible as a business expense . Additionally, the higher limit applies to acquisition indebtedness incurred after December 15, 2017 if the proceeds were used to refinance existing acquisition indebtedness . For the tax year ending December 2017, interest paid on a home mortgage may be taken as an itemized deduction on Schedule A of Form 1040.

Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

If you used the proceeds of the mortgages on line 12 for more than one activity, then you can allocate the interest on line 16 among the activities in any manner you select . A mixed-use mortgage is a loan that consists of more than one of the three categories of debt . For example, a mortgage you took out during the year is a mixed-use mortgage if you used its proceeds partly to refinance a mortgage that you took out in an earlier year to buy your home and partly to buy a car . If you receive a Form 1098 from the cooperative housing corporation, the form should show only the amount you can deduct.

For much of the twentieth century all consumer loan interest was deductible. This policy became expensive, especially during the 1970s’ credit card boom. As a result, the personal interest deduction provisions were scrutinized in the 1980s. Currently, the home mortgage interest deduction allows itemizing homeowners to deduct mortgage interest paid on up to $750,000 worth of principal, on either their first or second residence. This limitation was introduced by the Tax Cuts and Jobs Act and will revert to $1 million after 2025.

She conducts administrative or management activities there and she has no other fixed location where she conducts substantial administrative or management activities. The fact that she conducts some administrative or management activities in her hotel room does not disqualify her home office from being her principal place of business. She meets all the qualifications, including principal place of business, so she can deduct expenses for the business use of her home. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. The term “home” includes a house, apartment, condominium, mobile home, boat, or similar property which provides basic living accommodations. It also includes structures on the property, such as an unattached garage, studio, barn, or greenhouse.

In general, you will deduct the business portion of these expenses on Schedule C or Schedule F as part of your deduction for business use of your home. If you itemize your deductions, you will deduct the personal portion of these expenses on Schedule A . You do not have to use a particular method of recordkeeping, but you must keep records that provide the information needed to figure your deductions for the business use of your home. You should keep canceled checks, receipts, and other evidence of expenses you paid. You can use either the standard meal and snack rates or actual costs to calculate the deductible cost of food provided to eligible children in the family daycare for any particular tax year. If you choose to use the standard meal and snack rates for a particular tax year, you must use the rates for all your deductible food costs for eligible children during that tax year.

The allowable interest deduction for home equity indebtedness may be added to the allowable interest deduction for acquisition indebtedness even if the acquisition indebtedness exceeds the $1,000,000 limitation. Simply stated, the maximum allowable indebtedness is $1,100,000 ($550,000 married filing separately) after combining the acquisition indebtedness and the home equity indebtedness. Home mortgage interest taken as an itemized deduction will be limited in 2018 through 2025. Only the interest paid or accrued on acquisition debt will be eligible for the deduction in those years.

Include the average balance for the current year for any home acquisition debt part of a mixed-use mortgage. Generally, you can deduct the home mortgage interest and points reported to you on Form 1098 on Schedule A , line 8a. If you paid more deductible interest to the financial institution than the amount shown on Form 1098, show the portion of the deductible interest that was omitted from Form 1098 on line 8b. Attach a statement to your paper return explaining the difference and print “See attached” next to line 8b.

Under the loan agreement, Sharon must make principal payments of $1,000 at the end of each month. During 2022, her principal payments on the second mortgage totaled $10,000. If you receive a refund of interest in the same tax year you paid it, you must reduce your interest expense by the amount refunded to you.

The following two rules describe how to allocate the interest on line 16 to a business or investment activity. 535 for an explanation of how to determine the use of loan proceeds. Multiply the amount in item 1 by the decimal amount on line 14. Enter the result on Schedule A , line 8a or 8c, whichever applies.

No comments:

Post a Comment