Table of Content

If your home office is a separate structure, in connection with one or more of your trades or businesses. Pamela is a self-employed sales representative for several different product lines. She has an office in her home that she uses exclusively and regularly to set up appointments and write up orders and other reports for the companies whose products she sells. She occasionally writes up orders and sets up appointments from her hotel room when she is away on business overnight. You have suitable space to conduct administrative or management activities outside your home, but choose to use your home office for those activities instead. The space you use is a separately identifiable space suitable for storage.

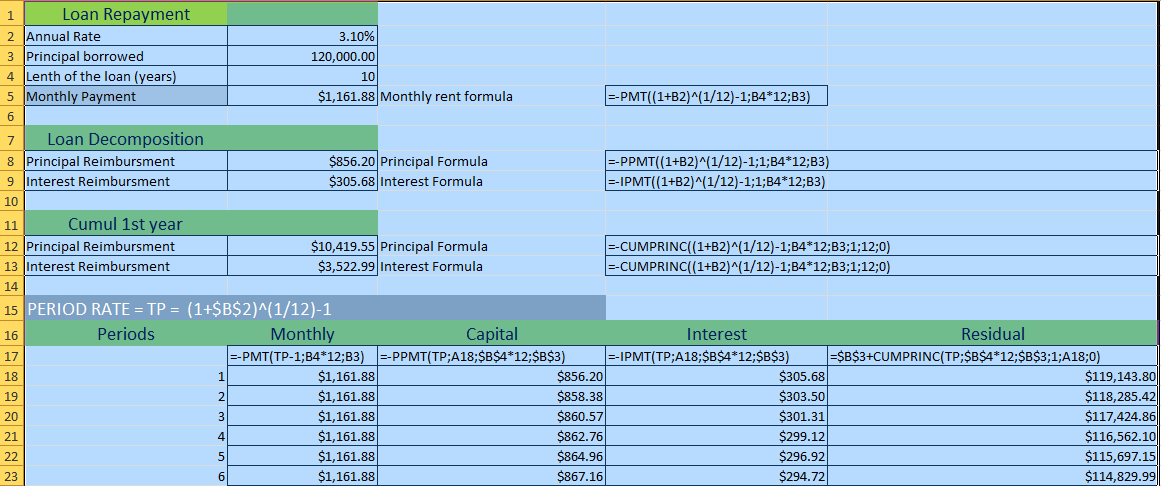

After the TCJA, home equity loans are now included within the mortgage’s principal, and interest is only deductible if used to build or improve a qualifying residence. In 2022, Bill refinanced that mortgage with a 15-year $100,000 mortgage loan. Two points ($2,000) were for prepaid interest, and one point ($1,000) was charged for services, in place of amounts that are ordinarily stated separately on the settlement statement. Bill paid the points out of his private funds, rather than out of the proceeds of the new loan.

How Does LendingTree Get Paid?

Since the room was available for business use during regular operating hours each business day and was used regularly in the business, it is considered used for daycare throughout each business day. The basement and room are 60% of the total area of her home. In figuring her expenses, 34.25% of any direct expenses for the basement and room are deductible.

The basis for depreciation of property changed from personal to business use is the lesser of the following. He multiplies $1,975 by 14.29% (0.1429) to get his MACRS depreciation deduction of $282.23. After you have determined the cost of the depreciable property and whether it is 5-year or 7-year property, use the table, shown next, to figure your depreciation if the half-year convention applies. To meet the adequate records requirement, you must maintain an account book, diary, log, statement of expense, trip sheet, or similar record or other documentary evidence that is sufficient to establish business/investment use. If your business use of listed property is 50% or less, you cannot take a section 179 deduction and you must depreciate the property using the Alternative Depreciation System . You do not have to reduce the gain by any depreciation you deducted for a separate structure for which you cannot exclude the allocable portion of the gain.

Standard Deductions

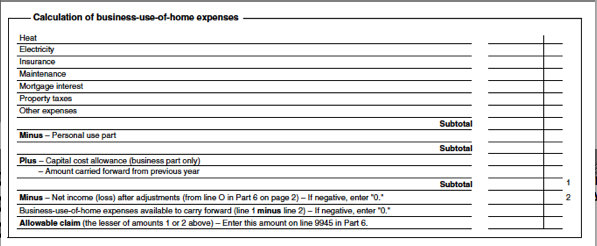

Form 8829 and the Worksheet To Figure the Deduction for Business Use of Your Home have separate columns for direct and indirect expenses. If your housing is provided free of charge and the value of the housing is tax exempt, you cannot deduct the rental value of any portion of the housing. June Quill, a self-employed attorney, works 3 days a week in her city office. She works 2 days a week in her home office used only for business.

However, some of these popular deductions have been slightly modified, and in unfavorable ways for taxpayers. If you used the same area for your qualified business use for the entire year, complete only Part I; otherwise, skip Part I and complete Part II using lines 1 through 5 to help you figure the amount to enter for each month. All amounts reported on this worksheet must be in square feet.Part I. Same area was used for the entire year.1.Area used for this qualified business use1._____2.Shared use. Complete line 2 if someone else also used the home to conduct business that qualifies for the deduction; otherwise, enter 300 on line 2d and go to line 3.a.Area not shared.

What is the mortgage interest deduction?

To do so, you must have e-filed your original 2019 or 2020 return. Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. The IRS is committed to serving our multilingual customers by offering OPI services. The OPI service is a federally funded program and is available at Taxpayer Assistance Centers , other IRS offices, and every VITA/TCE return site. The Tax Withholding Estimator (IRS.gov/W4app) makes it easier for everyone to pay the correct amount of tax during the year. The tool is a convenient, online way to check and tailor your withholding.

As a result, homeowners are always looking for a break when it comes to property taxes, mortgage interest, and other tax-related deductions. The bad news is that some of these deductions are getting smaller. In terms of popularity, an October 2017 opinion poll by Economist/YouGov found some people are unwilling to see the mortgage interest deduction go, even for an increase in the standard deduction. About 41 percent of all surveyed said they opposed eliminating the MID if Congress were to increase the standard deduction; that opposition rose to 66 percent among homeowners who itemize their taxes. Many homeowners will be blissfully unaffected by the TCJA’s new limits on deducting home mortgage interest.

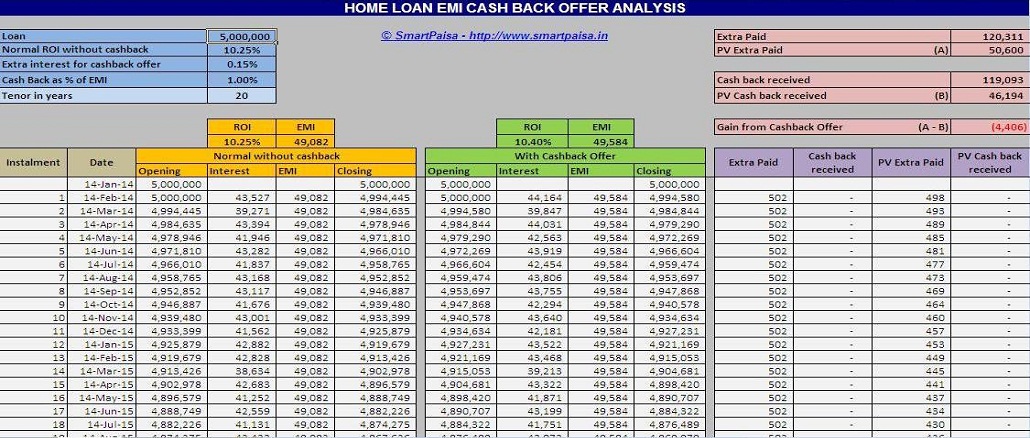

Assuming that the investment needed a 6 percent after-tax return in order to break even and satisfy investors, the investment’s rate of return needed to increase by 50 percent to cover the tax. The TCJA reduced the amount of principal available for the HMID from $1 million to $750,000. This increased the tax burden on owner-occupied housing, particularly for debt-financed homes. These limitations bias the tax code toward equity-financed homeownership and increase the tax burden on owner-occupied housing overall. Though the HMID is often viewed as a policy that increases the incidence of homeownership, research suggests the HMID does not accomplish this goal. There is, however, evidence that the HMID increases housing costs by increasing demand for housing among itemizing taxpayers.

Sally owns her home and has a mortgage principal remaining of $100,000, meaning she has $100,000 left to pay off. She makes annual mortgage payment of $6,080 at an interest rate of 4.5%. You were divorced or separated and you or your ex has to pay the mortgage on a home you both own .

In most cases, the allowable area is the smaller of the actual area of your home used in conducting the business and 300 square feet. You can use the Area Adjustment Worksheet , near the end of this publication, to help you figure your allowable area for a qualified business use. If you are a partner or you use your home in your farming business and file Schedule F , you can use the Simplified Method Worksheet, near the end of this publication, to help you figure your deduction.

After the passage of TRA86 the deductibility of personal interest was reduced to 65% and home mortgage interest remained. For the purposes of the mortgage interest deduction, a "qualified residence" means the taxpayer's primary residence or second home . When you figure your itemized deduction for state and local taxes on Schedule A, only include the personal portion of your real estate taxes on line 5b of Schedule A.

Eligible mortgage interest can be taken on a primary residence and one other secondary residence. A primary or secondary residence is defined as any house, vacation home not rented out during the year, condominium, Co-op, mobile home, trailer, or boat. Now, in prior years, this has allowed millions of people to deduct their mortgage interest. However, the Tax Cuts and Jobs Act nearly doubled the standard deduction, and as a result, fewer people will be able to use the deduction. If you and another person both used the home to conduct business that qualifies for the deduction, the same area cannot be used by both persons to figure the deduction. On line 32, total all allowable business use of the home deductions.

Home acquisition debt is a mortgage you took out after October 13, 1987, to buy, build, or substantially improve a qualified home . Receives at least 80% of its gross income for the year in which the mortgage interest is paid or incurred from tenant-stockholders. For this purpose, gross income is all income received during the entire year, including amounts received before the corporation changed to cooperative ownership. When you took out a $100,000 mortgage loan to buy your home in December, you were charged one point ($1,000). You meet all the tests for deducting points in the year paid, except the only funds you provided were a $750 down payment. Of the $1,000 charged for points, you can deduct $750 in the year paid.

Homeowners who bought houses after Dec. 15, 2017, can deduct interest on the first $750,000 of the mortgage. Claiming the mortgage interest deduction requires itemizing on your tax return. Under the new tax law, the average American will no longer be able to deduct moving expenses from their tax returns. In years past, if you met certain criteria regarding distance moved and total costs of your move, you could deduct those expenses from your income. Now, only active duty service and military members can deduct moving expenses. Policymakers could improve economic efficiency by making the tax burden on owner-occupied housing closer to the tax burden placed on other capital assets, either by eliminating the deduction or by removing capital from the tax base.

Average Mortgage BalanceAverage of first and last balance method. Therefore, refinancing a mortgage that was incurred prior to December 15, 2017 will generally not impact the limitation amount . If you put less than 20% down when buying your home, you most likely have to pay private mortgage insurance, or PMI.

No comments:

Post a Comment